F.A.Q

Is it possible to not pay tax in South Africa?

Unfortunately, the answer is no. Among all the tax types such as income tax, VAT, capital gains tax etc, you will find that some way or another you are paying taxes.

However, you can plan for taxes. Using the law to your advantage by structuring your expenditures in a tax efficient manner.

We do have guidelines and systems that can lead to you paying considerable less taxes.

Contact us and tell us what your current tax landscape looks like, maybe we can help you lower your tax burden like we have done for countess others.

However, you can plan for taxes. Using the law to your advantage by structuring your expenditures in a tax efficient manner.

We do have guidelines and systems that can lead to you paying considerable less taxes.

Contact us and tell us what your current tax landscape looks like, maybe we can help you lower your tax burden like we have done for countess others.

Well, how can I pay less tax?

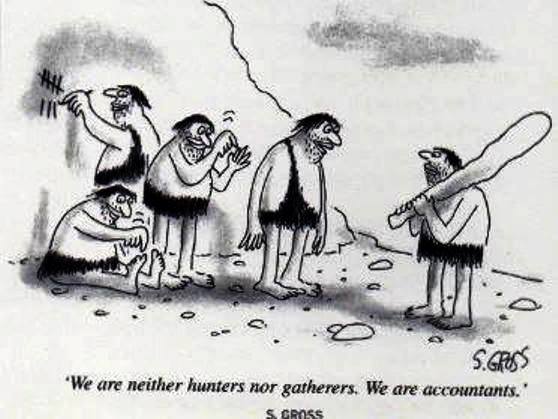

Accountants make their living by saving their clients’ money and time, in short getting an accountant is the most cost effective option.

Contact us and tell us what your current tax landscape looks like, maybe we can help you lower your tax burden like we have done for countess others.

Contact us and tell us what your current tax landscape looks like, maybe we can help you lower your tax burden like we have done for countess others.

But how does an accountant get it right so that I pay less tax.

We record your financial transactions into organised accounts on a periodic bases depending on your volume and complexity. Then we take this information, advise you on how to spend your money more tax-wise, and then utilize the income tax breaks available to you to lower your tax liability.

Over time you become more taxwise, and we help you save tax money – sometimes piles of it.

Later we create more tax deduction opportunities by implementing business structures and systems.

The trick is to start the process. Contact us so that we can help you, like we have helped so many others.

Over time you become more taxwise, and we help you save tax money – sometimes piles of it.

Later we create more tax deduction opportunities by implementing business structures and systems.

The trick is to start the process. Contact us so that we can help you, like we have helped so many others.

Do you do tax for individuals?

Yes, we do

I have started a new business. Can you help me, I don’t know what I must do next?

Yes, we would love to assist you. Make an appointment and bring your documentation, like your company registration and bank account - if you have, with. Come and tell us what you are doing, and we will help you to map out your next few steps and explain the path ahead.

A new adventure could be daunting but to us it is something exiting, and it can lead to a bucketload of fun.

A new adventure could be daunting but to us it is something exiting, and it can lead to a bucketload of fun.

When do I have to register for VAT and what does it involve?

As soon as you reach R1 000 000.00 turnover in a 12-month period or less, you need to register for VAT – quickly. SARS does show their claws if you take your time.

Give us a call and let us explain it to you. Like all taxes – it is never that simple, but it is not that bad either, as long as you get it right and keep it right.

Give us a call and let us explain it to you. Like all taxes – it is never that simple, but it is not that bad either, as long as you get it right and keep it right.

I have a business that has been running for a few years and need a new accountant. Wil you be able to assist me with SARS COIDA CIPC and the bargaining counsel?

We are geared to be a one stop shop and to take over your operations seamlessly. We use the latest technologies and most of our processes is done online and remotely.

Do I have to trade in a company?

No, you can trade in your own name.

There is most of the times good reason to rather use a company to trade in than your known ID number.

You need to consider that a registered company incurs maintenance costs, and to justify these expenses, it must fulfill certain requirements.

The justification lies in the risks associated with your trade. Will you face the risk of bankruptcy? Do your clients require you to operate as a registered company before considering you as their supplier? Are tax grants or deductions more accessible to a registered company?

Most of the times it is better to use a company since it has the function to safeguard your personal wealth when your trade goes belly up.

Give us a call to discuss your options

There is most of the times good reason to rather use a company to trade in than your known ID number.

You need to consider that a registered company incurs maintenance costs, and to justify these expenses, it must fulfill certain requirements.

The justification lies in the risks associated with your trade. Will you face the risk of bankruptcy? Do your clients require you to operate as a registered company before considering you as their supplier? Are tax grants or deductions more accessible to a registered company?

Most of the times it is better to use a company since it has the function to safeguard your personal wealth when your trade goes belly up.

Give us a call to discuss your options

How can I improve my cash flow, or more precisely - Why don’t I have money in the bank?

Cashflow management is something you need to pay attention to, daily – it does not happen by itself.

So, start early and keep at it.

Here is a couple of things you can start working on:

So, start early and keep at it.

Here is a couple of things you can start working on:

- Monitor and forecast cash flow - It mans you need to create one and use it. It will give you insight on future cashflow dead zones and once you recognise one, you can plan around it.

- Streamline accounts receivable, sometimes a % deposit from your clients avoid the deed to for expensive credit.

- Optimize accounts payable - discount for cash is what you are looking for.

- Manage inventory efficiently, dead stock can lead to dead companies.

- Control expenses, especially your personal expenses.

- Secure financing when needed and is affordable.

- Plan for seasonal variations.

- Seek professional advice.

How long should I keep my slips and documentation.

There are many rules in law on how long to keep documentation. The go to rule is the SARS rule: “Five years - counting from the date of you submitted your return”.

So, if you submitted your 2022 return on the 31 of January 2023 – then start counting from 1 March 2021 until 5 years after you submitted on 31 January 2023 This gives you ruffly 7 years to be safe.

Some documentation like purchasing assets and property is even longer.

Our rule is to keep documentation like you pay taxes - until after I died.

So, if you submitted your 2022 return on the 31 of January 2023 – then start counting from 1 March 2021 until 5 years after you submitted on 31 January 2023 This gives you ruffly 7 years to be safe.

Some documentation like purchasing assets and property is even longer.

Our rule is to keep documentation like you pay taxes - until after I died.

Home office claim - Can I claim my bond's interest costs as part of my claim?

Yes, but… There is a long list of if’s, but’s, and when’s before they will allow a home office deduction and even more if it is your bond interest.

Be pared to scratch for documents and do some planning and work, but if you are a commission earner or rent you home, it is still well worth the effort.

Normal employees and office bearers (directors, etc.) will not be allowed to claim their bond’s interest that was often the largest part of the claim.

See the blog below if you want to read more about this.

Be pared to scratch for documents and do some planning and work, but if you are a commission earner or rent you home, it is still well worth the effort.

Normal employees and office bearers (directors, etc.) will not be allowed to claim their bond’s interest that was often the largest part of the claim.

See the blog below if you want to read more about this.

Do you want to add a question?

Please do!

Use the contact us space below.

The good ones go on the board, the great ones go on top of the board.

Use the contact us space below.

The good ones go on the board, the great ones go on top of the board.

Kindly stay aware who is answering these questions.